Candlestick Pattern

Unlocking the Power of Candlestick Patterns in Trading

1. Introduction

If you’re venturing into the world of trading, you’ve probably heard the buzz about candlestick patterns. But what exactly are they? Simply put, candlestick patterns are visual tools that help traders understand price movements over a specific period. They’re like a secret language of the market that tells you when to buy or sell. Why are they so crucial? Because they provide insights into market sentiment, which can be the key to successful trading!

2. Basics of Candlestick Charts

Before we dive into specific patterns, let’s break down the basics of candlestick charts.

2.1 Components of a Candlestick

Every candlestick consists of three main parts: the body, the wick, and the color.

- Body: The thick part of the candlestick that shows the opening and closing prices.

- Wick (or Shadow): The lines above and below the body, indicating the highest and lowest prices during that period.

- Color: A green or white body usually means the price closed higher than it opened (bullish), while a red or black body indicates the opposite (bearish).

2.2 Timeframes and Their Importance

Candlesticks can represent different timeframes, from one minute to daily or even weekly. Short-term charts can help day traders spot quick opportunities, while longer timeframes provide a broader market perspective. Think of it as zooming in and out on a map—you’ll see different details at different levels.

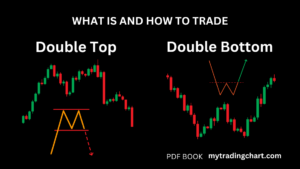

3. Types of Candlestick Patterns

Candlestick patterns can be categorized into two main types: single candlestick patterns and multiple candlestick patterns.

3.1 Single Candlestick Patterns

These patterns consist of a single candlestick and can convey powerful signals on their own.

3.2 Multiple Candlestick Patterns

These patterns involve two or more candlesticks and provide even more context and signals for traders.

4. Common Single Candlestick Patterns

Let’s explore some common single candlestick patterns and how you can leverage them in your trading.

4.1 Hammer

The hammer pattern appears after a downtrend and indicates a potential bullish reversal. It has a small body with a long lower wick, resembling a hammer ready to strike. Spotting this pattern could mean it’s time to consider buying!

4.2 Inverted Hammer

Similar to the hammer, the inverted hammer also appears after a downtrend but signals potential bullish momentum. Its long upper wick and small body indicate that buyers are starting to step in.

4.3 Shooting Star

This pattern occurs after an uptrend and suggests a possible bearish reversal. The shooting star has a small body and a long upper wick, signaling that buyers tried to push prices up but failed, leading to potential selling pressure.

5. Common Multiple Candlestick Patterns

Now, let’s look at some powerful multiple candlestick patterns that can enhance your trading strategy.

5.1 Engulfing Pattern

The engulfing pattern consists of two candlesticks—one smaller candlestick followed by a larger one that completely engulfs it. A bullish engulfing pattern occurs after a downtrend and signals a potential reversal. Conversely, a bearish engulfing pattern appears after an uptrend and indicates potential selling pressure.

5.2 Doji

The doji is a unique candlestick that signifies indecision in the market. It has a very small body, with wicks that are roughly equal in length. Depending on its position, it can signal potential reversals, so pay attention!

5.3 Morning Star and Evening Star

The morning star is a three-candlestick pattern that indicates a bullish reversal, typically appearing after a downtrend. The evening star is its bearish counterpart, suggesting a potential reversal after an uptrend. These patterns can be game-changers if identified correctly.

6. The Psychology Behind Candlestick Patterns

Understanding the psychology behind candlestick patterns can provide deeper insights into market behavior. Each pattern reflects traders’ emotions—fear, greed, or indecision. When you grasp this psychology, you can make more informed trading decisions, like reading the mood of a crowd at a concert.

7. How to Analyze Candlestick Patterns

Analyzing these patterns effectively requires the right approach and tools.

7.1 Tools and Software

Many traders use platforms like TradingView or MetaTrader to analyze candlestick patterns. These tools often come with built-in features that simplify pattern recognition and analysis.

7.2 Combining with Other Indicators

To enhance your candlestick analysis, consider combining them with other technical indicators like Moving Averages or the Relative Strength Index (RSI). This combo can provide more robust signals and reduce false positives.

8. Practical Tips for Trading with Candlestick Patterns

8.1 Confirming Signals

Always confirm candlestick signals with additional analysis. For instance, if you spot a hammer, check the volume to see if it supports the potential reversal. It’s like not buying a car without taking it for a test drive!

8.2 Setting Stop-Loss and Take-Profit

Risk management is crucial. Setting stop-loss orders helps protect your capital if the trade goes against you, while take-profit orders allow you to secure gains. Always plan your exit strategy before entering a trade.

9. Common Mistakes to Avoid

Even seasoned traders can make mistakes with candlestick patterns.

- Misinterpreting Patterns: Ensure you understand the context of the pattern. A hammer in a strong downtrend might not be as reliable.

- Ignoring Market Context: Always consider the broader market conditions, news events, and trends that might affect your trades.

10. Conclusion

Candlestick patterns are invaluable tools for traders, offering insights into market sentiment and potential price movements. By learning to recognize and analyze these patterns, you can enhance your trading strategies and improve your decision-making. Remember, every pattern has a story to tell—it’s up to you to listen!

11. FAQs

What are the most reliable candlestick patterns?

Some of the most reliable patterns include the hammer, engulfing patterns, and doji, as they often signify strong market sentiment.

How do I practice reading candlestick patterns?

You can practice by analyzing historical charts and using trading simulators. This hands-on experience helps solidify your understanding.

Can candlestick patterns be used in all markets?

Absolutely! Candlestick patterns are versatile and can be applied across various markets, including stocks, forex, and cryptocurrencies.

What should I do if a candlestick pattern fails?

Don’t get discouraged! Analyze what went wrong and adjust your strategy accordingly. Every trader faces setbacks; learning from them is key.

Are candlestick patterns better than other charting methods?

It depends on your trading style! Many traders find that combining candlestick patterns with other technical analyses yields the best results.

Leave a reply